Your Credit Score has a Big Impact on Loan Costs

Whether you realize it or not, there is a three-digit number associated with your name that has a big impact on your financial life. It is your credit score. There are many types of credit scores, and even versions within the same scoring method, but the most common in the U.S. is FICO® which is a credit scoring model and software created by the Fair Isaac Corporation.

Any of the credit scoring models attempt to calculate your ability and likelihood of paying a loan based on several factors.

According to MyFICO.com, their scores are calculated based on data from five categories: payment history (35%), amounts owed (30%), length of credit history (15%), new credit (10%), and credit mix (10%). A FICO® is calculated only by what information is contained within your credit report (another reason to confirm its accurate).

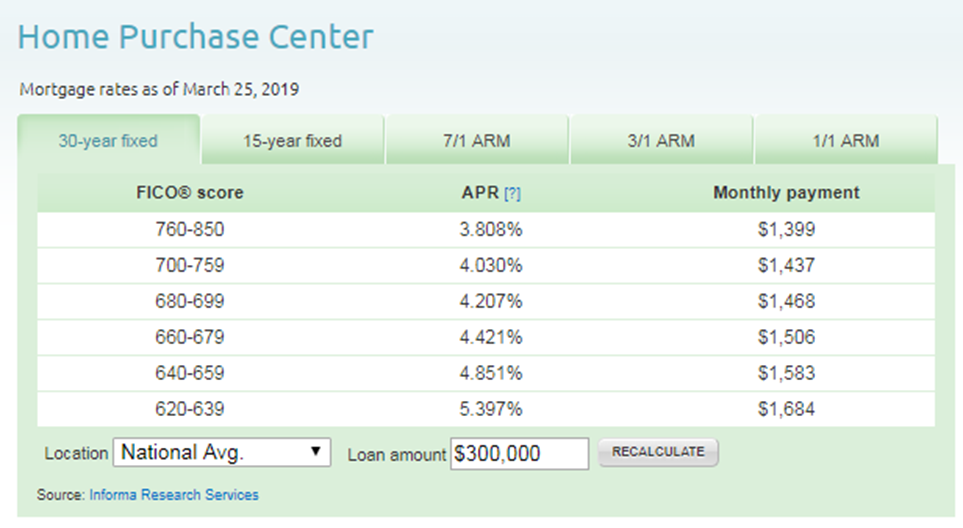

Now let’s see how those scores impact the cost of borrowing money for a home. Below is a chart that assumes a 30-year fixed interest rate mortgage of a $300,000 loan using rates available on March 25, 2019. Most mortgage lenders require a minimum credit score of 620 but many may require higher. Regardless, the lower your credit score, the more you will pay for your home mortgage which is compounded over time.

The lower your credit score, the more you will pay for your home mortgage!

In the example below, those with low credit scores would have be given an annual percentage rate (APR) of 5.397% while those with top scores would receive 3.808%. That may not seem that big of a deal until you look at from the perspective of the monthly payment and total difference over the course of the 30-year loan. The difference of $285 in monthly payment for every month over 30 years. The eye opener is the difference in the amount of interest paid over those 30 years, which calculates to $102,525!

So the difference in loan terms means that $300,000 priced home costs the person with good credit a total of $503,726 in mortgage payments and $606,251 for someone with a low credit score.

Mind blowing, right? Luckily, there are many ways to improve your credit score over time. Check out our post on Buyer Basics: Ways to Boost Your Credit Score to learn how.